Our first phase of Pathways to the Future, completed in 2014, was a great success. It provided the campus with a new 28,000-square foot Health Science facility, endowment funding for scholarships, and support for deferred maintenance.

Now we are setting a new goal.

One that will benefit the entire community: A new Athletic Complex at LCC.

Benefits to the entire community include an economic boost to Southeast Kansas; new multi-purpose community venue space; expanded youth programs and opportunities; and a vibrant synergy with Main Street.

The time is now to act: A Campaign for a New Athletic Complex. In the past 10 years, we have made numerous renovations and created new spaces for academics and student life on campus. It is now time to improve our athletic facilities and to enhance the quality of life for our entire community.

When complete, the gym will be transformed into a multi-use space for athletics, academics & community events. Other support for the campaign will provide additional endowment funding for scholarships and ongoing facility maintenance, and support for our Annual Fund Drive.

Our goal is to bring the current athletic facility up to the standard of other Kansas community college facilities. Currently, our athletic facility is one of the least impressive structures in the prestigious Jayhawk Conference.

This project is long overdue, and when the project is complete, our new facility will help LCC to recruit, retain, and develop top athletes and coaches. In addition, the new facility will provide numerous outlets for fitness, exercise, self-discipline, healthy activities, and general well-being for all LCC students.

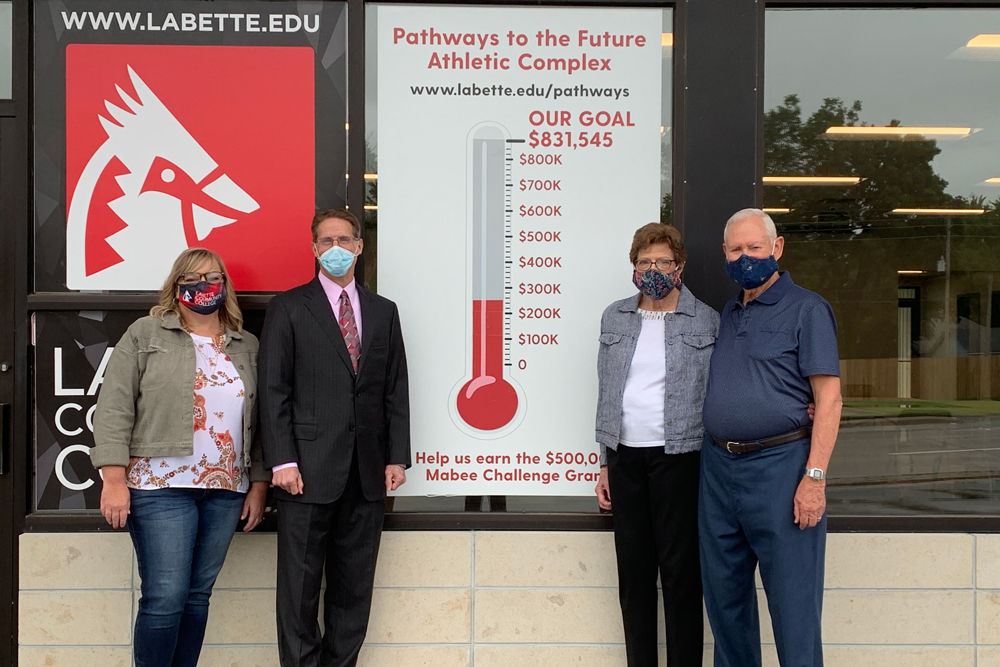

Doug and Tammy Farley, former Parsonians, have pledged $100,000 to support the next phase in Labette Community College Foundation’s Pathways to the Future Capital Campaign. This gift will help the college renovate and expand the athletic facilities to meet the needs of students and better serve the community.

Read full press release

Sophia Zetmeir, former Parsonian, has pledged an additional $50,000 to support the next phase in Labette Community College Foundation’s Pathways to the Future Capital Campaign. Zetmeir kicked off the campaign in 2019 with the lead gift of $1,000,000. Her newest gift to the Pathways campaign will ensure the goal of naming the new wrestling room the “Jody Thompson Wrestling Room” will be met.

Read full press release

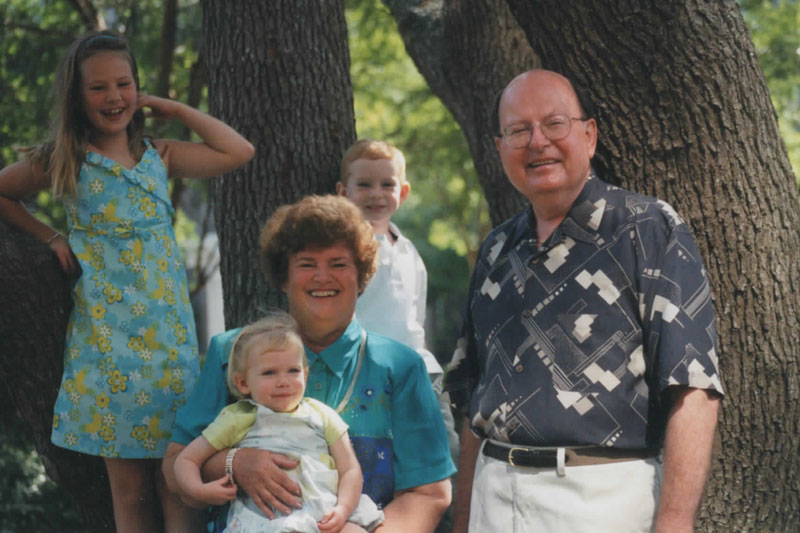

The Latzers have a long-standing tradition of support for Labette Community College students. In addition to supporting the Pathways to the Future Capital Campaign to construct the new Health Science building, the Latzers created the Latzer Art Award, an endowment through the Parsons Area Community Foundation in partnership with the LCC Foundation. The Latzer Art award is presented twice a year to LCC students who display promise in the fine arts realm. The couples passion for the arts is recognized through an art display case and plaque in the Reese H. Hughes Arts & Humanities building on the main campus.

Read full press release

“Union Pacific has a long-standing commitment to improve the quality of life in the communities they serve and where their employees live and work. Their vision is that Union Pacific employees will take pride in their company's civic leadership and that customers and shareholders will appreciate and recognize Union Pacific as an excellent corporate citizen.

Read full press release

“We invest in our communities by supporting programs that strengthen community cohesion,” said Bob Nicholson, Parsons Walmart store manager. “The Labette Community College Foundation is clearly strengthening our community through higher education and improvements to the local campus. Walmart is proud of the change LCC is bringing and pleased to add our support. Many of our associates and/or their family members have been or currently are LCC students and graduates.”

Read full press release

The Lubbers believe the college provides tremendous benefit to the communities it serves. “Education is a key component of any productive society, so it is critical to provide quality education at a local level,” said Chris. “Our Strategic Partners team is deeply rooted in Parsons, and want to positively impact the community. LCC is an integral part of the community, so we want to see it prosper and grow.”

Read full press release

“It is a great benefit to have the community college in Parsons to offer higher education close to home at a reasonable cost,” Wall said. “The college is an important economic factor in our area – the educational opportunities and employment positions is a real boost to our economy. The students and staff all spend money and live in the Parsons area and the surrounding counties.”

Read full press release

Labette Community College announced a $150,000 gift from The Sunderland Foundation of Overland Park, Kansas that will provide significant support for LCC’s Pathways to the Future Capital Campaign to renovate and expand the college athletic facilities. This gift is the second grant the Sunderland Foundation has given in support of this project. In 2017, they were one of the first donors to the project by giving a $100,000 grant.

Read full press release

The Crossland Family has lived in Southeast Kansas their entire lives. “Being a part of this community has been a blessing to us, and we do our best to give back. LCC is an important institution to our community, and we are honored be a part of the mission,” say Curt. “Getting to be a part of the legacy LCC leaves is a privilege for our family. It is an honor to be a part of this partnership, getting to know the people, and having the opportunity to give of our time and money.”

Read full press release

The heads of the flourishing business and Beachner family, Corky and Alice, believe that Labette Community College has had a major impact on their community. “LCC has made higher education affordable and accessible in our community,” said Corky. “The college helps train health care workers for local hospitals and communities, which is so important.”

Read full press release

“LCC’s role in the region aligns with our mission as a community bank, and we are enthusiastic to embark on this partnership with the college’s athletics and wellness programs,” Commercial Bank President Ray Jacquinot said. “As a community bank, we could not see a better organization to support and align ourselves with than the LCC Cardinals.”

Read full press release

“Many of our employees, customers, and many in my own family have received their education at LCC. Those individuals are valuable employees and contributors to our communities,” Peters said of LCC. “My wife and daughter are both products of the LCC Nursing program, which provided them an excellent education and prepared them for great careers.”

Read full press release

1

You can deduct cash gifts up to 50 percent of adjusted gross income. On a $10,000 cash gift in a 28 percent tax bracket, you save $2,800 in taxes.

2

You can deduct cash pledged over a period of years, up to 50 percent of adjusted gross income for the portion given each year. On a $30,000 cash gift over three years ($10,000 each year) in a 28-percent bracket, you save $2,800 in taxes that year.

3

Appreciated stock (held more than one year) makes an excellent gift. You avoid all capital gain taxes, will receive a tax deduction, and can deduct it up to 30 percent of your adjusted gross income.

4

Bonds and mutual funds are similar to cash in their tax treatment. State, Municipal, and U.S. Government Bonds are welcome.

5

The P.O.D. stands for Payable on Death. You retain full ownership and full control during your life. At your death, the account balance is paid to your named beneficiary immediately and without probate.

6

In exchange for a gift of cash, stock or securities, the organization will pay you, you and your survivor, or another person you name, a guaranteed income for life. You receive a substantial tax deduction in the year of the gift and part of the income is tax-free. Upon your death, the gift remainder supports the campaign.

7

Similar to a gift annuity except that payments begin at a future date determined by you – retirement for example. Your tax deduction and annual rate of return increase the longer you wait to start payments. A super retirement planning vehicle.

8

This is similar to a mutual fund and you receive a portion of the fund’s annual income. You receive a substantial current year tax deduction and can avoid capital gain taxes if the gift is made with appreciated securities. Additions can be made easily. Upon your death, the fund is available to the organization.

9

Donors can select the rate of return from these income arrangements and also choose a fixed or fluctuating annual payment. Capital gain taxes are completely avoided and you will receive a tax deduction based on the age of the income recipient and the rate of return.

10

In a charitable lead trust assets (cash or securities) are transferred to a trust that pays income from the fund to the organization for a predetermined number of years. At the end of the time period, the trust terminates and the assets are given back to the persons you name. The income tax deduction is for payments made annually to the organization.

11

One of the simplest ways is to give of your estate. You can make a gift bequest, after others have been provided for, of a dollar amount, specific property, a percentage of the estate, or what is left (remainder) to the organization.

12

The gift that can be taken back! Gifts should only be made on a permanent basis when it is in your best interest to do so. The revocable trust provides for gifts of cash, property, and/or income now, while retaining the rights to retrieve the property if necessary. There is no tax deduction for the gift but there are savings in estate settlement costs if the trust is not revoked.

13

A simple way to make a significant future gift is to name the organization beneficiary to receive all, or a portion of the proceeds of an existing life insurance policy. You will receive a tax deduction for the cash surrender value, thus reducing your tax liability in the year of the gift.

14

You receive an income tax deduction for each premium as made and provide a major gift to the organization with a modest annual payment.

15

Retirement Account Funds (IRA’s or company plans) beyond the comfortable support of yourself or loved ones may be given (like life insurance proceeds) to the organization by proper beneficiary designation.

16

Gifts of personal property are always welcome, including collections, royalty, and mineral rights. Charitable tax deductions are available in the year of the gift.

17

One of the most overlooked gift forms is real estate. We will be happy to discuss the possible gift of land, a house, or vacation home. You will receive a tax deduction for the full fair market value, as well as avoiding all capital gain taxes.

18

Receive a substantial income tax deduction by giving (deeding) your home or farm to the organization now. You continue to live there, maintain the property as usual, and even receive any income it generates. At your death, the organization will sell your property to support the campaign.

19

Gifts of goods or services are accepted by the organization with prior approval by the Campaign Steering Committee. Ordinarily these gifts will be credited toward the campaign at their full fair market values as determined by appraisal or other appropriate valuation techniques.

We are at $5,844,528 toward our $5,729,000 capital goal.

While our official goal has been met, the campaign will continue to accept donations to support our ongoing efforts to meet the needs of students.

Students Enrolled

Degrees Offered

Certificates Offered

NJCAA Sports

Your generosity has inspired me to help others and give back to my community. I hope one day I will be able to help students achieve their goals just as you have helped me.

Her passion is softball and she is blessed to have the opportunity to continue playing the sport she loves at the collegiate level. In Gwen's spare time she enjoys coaching and giving back to the sport she loves. "We rise by helping and lifting others. "

Your generosity has inspired me to help others and give back to my community. I hope one day I will be able to help students achieve their goals just as you have helped me.

Her passion is softball and she is blessed to have the opportunity to continue playing the sport she loves at the collegiate level. In Gwen's spare time she enjoys coaching and giving back to the sport she loves. "We rise by helping and lifting others. "

My sophomore season at Labette has come to an end, and I'm honored to have played next to everyone on my team. I'm never going to forget the memories we make and the times we spend together as brothers and teammates. Labette has been the best two years of my life.

My sophomore season at Labette has come to an end, and I'm honored to have played next to everyone on my team. I'm never going to forget the memories we make and the times we spend together as brothers and teammates. Labette has been the best two years of my life.